We made it! After a grueling and seemingly endless election cycle, we now know that Donald Trump will be the first President since Grover Cleveland to be re-elected to non-consecutive terms. As of Wednesday afternoon, the former President appears to have won all the swing states, and helped Republicans carry a larger majority in the Senate than pollsters had anticipated. The focus now turns to the House of Representatives, where Republicans had a more difficult path to maintaining control, but as of Wednesday afternoon, was also trending towards a Republican majority.

Equity futures began to rise sharply around 9pm as data from North Carolina and Georgia showed favorability to Trump. By the time Pennsylvania was called in the middle of the night, Dow futures had shot up over 1,200 points. The Dow closed up 1,508 points on Wednesday, notching it’s best day in two years. In the bond market, the yield on the 10 Year Treasury continued its march upwards, with yields hovering around 4.43%.

What does all this mean? In the short term, “animal spirits” are high based on expectations of continued lower corporate tax rates, looser regulation, and general excitement over the “pro-growth” agenda touted by the Trump-Vance campaign. In the medium to longer term, the economic question remains whether the tariff and immigration policies of Trump 2.0 will potentially dampen economic growth or lead to higher inflation. The key thing to watch at this point is who will have control of the House. While both Trump and Harris were likely to continue deficit spending, the combination of a Republican sweep and a Trump popular vote win would certainly give the Trump-Vance administration a mandate to pursue more deficit-funded spending policies. A Republican controlled congress would also potentially greenlight the full extension of the Tax Cuts and Job Act.

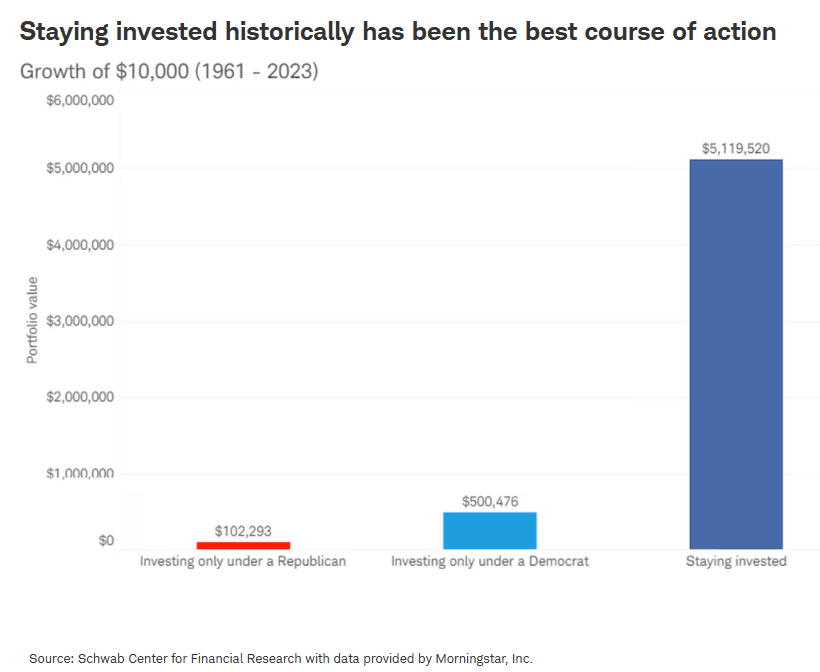

At the end of the day, long-term equity returns are largely agnostic to political party and the outcomes of elections (see graph below). Indeed, the ability to accurately forecast short term moves in markets is about as rare as the ability to accurately forecast election results. We remain convinced that a diversified portfolio that is rooted in quality and personalized to an investor’s own willingness, need, and ability to take risk, will continue to benefit investors in both the months and years ahead.

Our wealth management advisors can help you with our comprehensive suite of services designed to help you achieve your financial goals. Contact us today and let's start building your financial future.